Content

As mentioned above, if you use an https://www.bookstime.com/ integration, it automatically maps transactions to the right category. This can be based on the default chart of accounts it can create, or based on your own unique chart of accounts. For most dropshipping businesses, the default accounts will work fine. However, speaking to an accounting professional can help you to make sure. For those who have just started dropshipping, doing your own bookkeeping is fine in most cases, especially if you follow the tips in this article. As your business grows, it becomes more worthwhile to connect with an accountant. Depending on what type of services you need, an accountant can help with complicated taxes, digital ecosystems and business growth.

- If a customer purchases a good for you, you wouldn’t record this transaction until the money has actually hit your account.

- There are a few steps you can take to minimise the risks involved.

- From calculating taxes on online sales to inventory management to figuring out shipping logistics, running an online store comes with a whole host of challenges and considerations.

- Work closely with your own Head of Bookkeeping and a Bookkeeping Assistant to keep your books clean and to answer all finance related questions you have.

- But also, if a buyer returns the product, how do you track it?

Bookkeeping, a subset of accounting, involves recording and organising financial transactions regularly. Generally, an accountant will analyse the records provided by the bookkeeper in order to give financial advice. Inventory count and management are the lifeblood of all ecommerce companies. Accurate inventory tracking lets you know when to reorder products. If you have a great product to sell, ecommerce platforms like Shopify, Wix, or WooCommerce make selling easy. But merely having an ecommerce business is not enough for success.

Taxes for eCommerce Bookkeeping Beginners

Third-party ecommerce bookkeepingrs like FreshBooks offer invoicing, estimates, payroll services, and more. These days, it’s not hard to find decent bookkeeping software. FreshBooks is the perfect example of trustworthy and robust accounting software. There’s a lot of talk about how it’s essential to follow your gut in business. However, having access to reliable financial data is often more critical.

- These transactions must show up as part of your recordkeeping work.

- Likewise, accounting in an e-commerce business is something that people avoid like a plague.

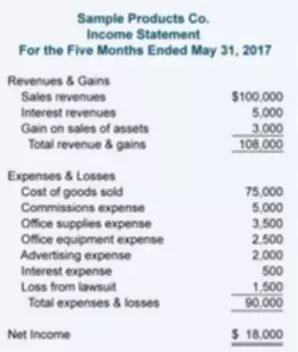

- To organize your records, you must know the five types of accounts where you must identify your transactions and one by one record it to the right account.

- Many of these software have pre-built filters and sorting functions, and can auto-sort expenses into their respective categories.

- This software is also specific to Shopify, which means it excludes every other sales platform or payment processing service you may use.

- This essentially involves putting together a list of categories and subcategories that each transaction can fit into.

- Each of these platforms handles its accounting differently, which means different payment processors, different methods of handling taxes, and different fees to consider.

Bookkeeping for any business, not just ecommerce, requires some financial ability. Here’s a simplified plan to help get you started with bookkeeping for your online store. This can happen when the integration between your online sales platform and your accounting software isn’t correctly mapped. If you’re not recording them accurately, then when you file your business taxes, you will inaccurately report your expenses and you could end up paying too much in taxes. Cash flow can be hard to comprehend and manage in any business but it’s critical that in an ecommerce business you come to understand this – or at least your bookkeeper does. One of the main benefits of ecommerce bookkeeping is being able to accurately manage your inventory levels. In this master guide to ecommerce bookkeeping we look at the key components you should have in place for your online store.

Still need help with eCommerce bookkeeping?

We understand some clients love being able to text their bookkeeper so you have that option as well. Work closely with your own Head of Bookkeeping and a Bookkeeping Assistant to keep your books clean and to answer all finance related questions you have. Meet with us on a Kickoff Call so we can fully understand your eCommerce business and develop a strong relationship for the long run.

The only downside of cash basis accounting is that it does not account for future receivables and payables. But if you’re using the right ecommerce accounting tools, you can still plan for these using other reports at your disposal. Once your ecommerce accounting solutions and policies are in place, you can spend less time on bookkeeping and more time growing other parts of your business. It’s impossible to accurately manage your finances and make sound money decisions if your accounting records aren’t in order. From organizing your payables and receivables to keeping track of your transactions and managing supplier invoices, there’s a lot to handle.

Prepare early for the tax season

Our professional accountants have experience working with ecommerce businesses and can provide the guidance and support you need to succeed. Contact us today to learn more about our services and how we can help your ecommerce business thrive. You should also be using ecommerce software that’s compatible with your accounting solution. Some online sales systems even have built-in ecommerce accounting tools.

One thing that tends to confuse people at the beginning is setting up the chart of accounts for e-commerce. This essentially involves putting together a list of categories and subcategories that each transaction can fit into. For example, a category could be expenses and a subcategory could be social media advertising.