Content

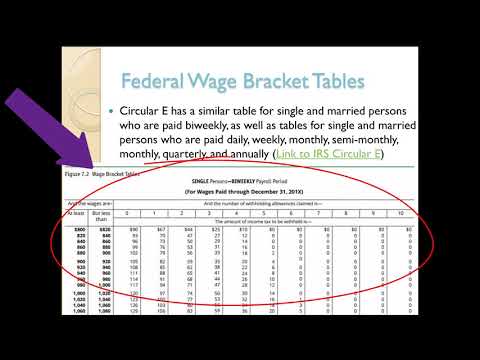

The employee portion of Social Security and Medicare taxes from lines 5a-5d may differ from the amounts you actually withheld from employees’ wages due to rounding. The decimal represents the rate of Social Security tax on taxable wages. Both you and your employee must contribute 6.2% each paycheck for Social Security.

This federal tax return must be filed every quarter, enabling the IRS to understand and assess the employers track of federal tax payments and filings. Form 941 can be filed electronically and by paper. To request a copy of a Maryland tax return you filed previously, send us a completed Form 129 by mail or by fax.

Small Business Programs

They must be ordered from the Employment Department. Please use Microsoft Edge browser to get the best results when downloading a form.

- USPS Address Validation Verifies your recipient addresses before copies are mailed.

- The refund application would be filed to request a refund of admissions and amusement tax that the taxpayer feels was improperly paid.

- For 2022, be sure to use the 2022 versions of Form 941.

- To register your business for A&A taxes complete the Combined Registration Application or register online to get an account number.

Your preparer must also check off whether or not they’re self-employed. If you hire employees seasonally, check the box on line 18. In Part 2, fill out information about whether you’re a semiweekly or monthly depositor. If you’re not sure which type of depositor you are, check IRS Publication 15, section 11.

How to create an eSignature for the 2020 form 941 instructions

You can also file your Maryland return online using our free iFile service. NerdWallet’s ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service. Your accountant or tax professional should also have access to e-File. This guide explains everything you need to know about IRS Form 941, along with step-by-step instructions to help you complete this form. Additional Medicare tax withheld from employee paychecks.

IRS sets January 23 as official start to 2023 tax filing season; more … – IRS

IRS sets January 23 as official start to 2023 tax filing season; more ….

Posted: Thu, 12 Jan 2023 08:00:00 GMT [source]

How UI Tax Rates Are Determined This informational flier explains how payroll tax rates are assigned in accordance with Oregon law, and how the benefit ratio is calculated. Employer, Employee and Wages This informational flier covers definitions related to employers, employees and wages as they pertain to Employment Department law. Business Contact Change FormUse this form to update your business contact information. This includes address and phone number updates, and offsite payroll service/accountant/bookkeeper updates. Authorization for Tax Withholding This document is used by unemployment insurance claimants to authorize the withholding of taxes from their unemployment insurance benefit payments.

When to Report Form 941?

Also, the document contains a https://intuit-payroll.org/ment voucher (941-v) as the inherent part of the record. Completing official forms might seem intimidating.

A third-party deFillable Online Instructions For Form 941 ee might be your CPA, enrolled agent or tax advisor. If you are granting authorization to a third-party designee, check the “Yes” box and fill in the person’s name and phone number.

Enter the qualified health plan expenses allocable to qualified sick leave wages for leave taken after March 31, 2021 and before October 1, 2021 on line 24. Enter this amount on Worksheet 2, Step 2, line 2b.

SignNow helps you fill in and sign documents in minutes, error-free. Choose the correct version of the editable PDF form from the list and get started filling it out. Look through the document several times and make sure that all fields are completed with the correct information. Use a form 941 instructions 2022 template to make your document workflow more streamlined. To ensure you are able to view and fill out forms, please save forms to your computer and use the latest version of Adobe Acrobat Reader.

Trusted applications are secured by OHID

If this credit applies to you, enter the amount of credit from Form 8974, line 12. 2023 Form Oregon Employee Detail ReportUse this form to report wages and/or tax withholdings.

- Just follow the below instructions to complete and File your form 941 to the IRS.

- You’re typing or using a computer to complete your form.

- The forms contained in these pages are in the Adobe .PDF format .

- Visit any of our taxpayer service offices to obtain forms.

- Once you have filled out the necessary info, re-read the form to avoid any possible mistakes and proceed to authorization.

- The only other form available to admissions and amusement tax filers is the admissions and amusement tax refund application.